FTX, SBF, UKRAINE: Sam Bankman-Fried Faces 100 Years in 28 Mar 24 Sentencing, Will Receive Reduced Sentence As Crimes Are Rebranded “Echoing Point”

Who was the primary beneficiary of the FTX/SBF money laundering and political kickback operation? Joe Biden, that's who.

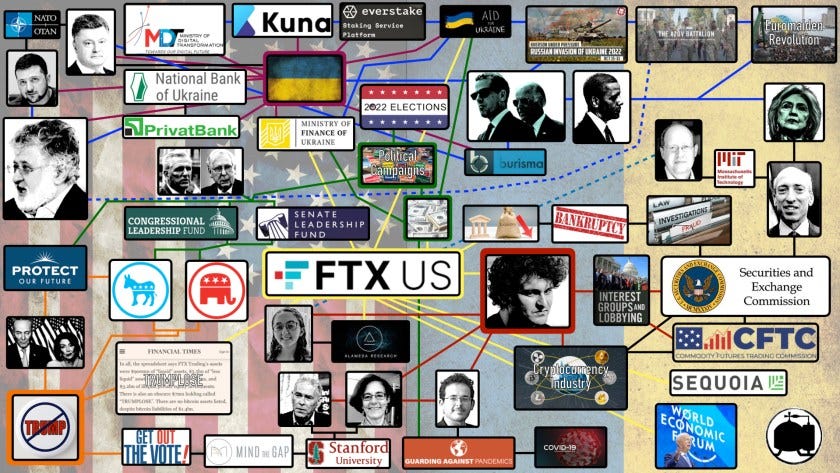

The FTX/Sam Bankman-Fried scandal is a critical component to the manufactured US proxy war against Russia that began with a foreign policy shift by the incoming Biden Administration, which I identified and analyzed back on 19 Dec 20: CRITICAL: The Pending Pivot Back to Russia. Enmeshed in this US/NATO proxy war is the US Intelligence Community proxy state of Ukraine wherein FTX was a conduit within globally scaled money laundering operations that were funneling US funds allocated for Ukraine in the form of military and humanitarian aid back to Joe Biden and scores of other US politicians after being laundered and converted to cryptocurrency. These illustrations tell the story and readers are left to independently catch-up on the much deeper underpinning fact set: THE KEYSTONE OF CORRUPTION.

On 02 Nov 23, former FTX CEO Sam Bankman-Fried was found guilty on all seven counts in his fraud trial where clients lost an estimated $8 billion in-part via in the money laundering and political kickback operation.

The first red flag that Americans ought to have immediately discerned long ago is that the prosecutors of SBF serve the DOJ, which serves the Biden Administration, which is run [supposedly] by President Joe Biden, who is the primary beneficiary of the FTX money laundering and political kickback operation.

These facts overlaid the original analysis that immediately followed SBF’s suspiciously timed arrest and positioned SBF’s forthcoming trial as an intelligence community concealment operation that will result in SBF receiving a reduced sentence: The Problematic and Highly Suspicious Timing of the Sam Bankman-Fried Arrest Gives Rise to Troubling Questions and Answers.

In that analysis and redundantly throughout the subsequent analysis, the findings routinely indicated that the Intelligence Community was engaged in clean-up and cover-up operations for Biden’s and a wide swath of the US politburo’s broader criminality.

The analysis held that SBF’s severe criminality would be rhetorically diminished into incompetence, laziness, inexperience, ignorance, etc.; anything but criminal intent, and where that narrative would be the basis for lenience in sentencing as an aspect of the concealment operation.

For those unfamiliar with these IC processes, that’s exactly how things have worked forever.

On the day of SBF’s conviction on all seven counts, US Attorney General Merrick Garland issued this statement: “Sam Bankman-Fried thought that he was above the law. Today’s verdict proves he was wrong. This case should send a clear message to anyone who tries to hide their crimes behind a shiny new thing they claim no one else is smart enough to understand: the Justice Department will hold you accountable. I am grateful to the U.S. Attorney’s Office for the Southern District of New York and the FBI for their outstanding work in bringing Mr. Bankman-Fried to justice.”

Shedding the veneer of Garland’s rhetoric, what the Attorney General is doing is establishing the narrative for the official DOJ high-road so as to give the illusion of impartiality towards 1-the matriculation of justice and 2-his literal immediate supervisor, which is the President, who is the nation’s chief law enforcement officer, who also happens to be SBF’s and FTX’s primary beneficiary.

By fraudulently hollering that the Justice Department held SBF “accountable” it can begin sweeping matters fully under the rug, which will begin with the reduced sentencing of SBF as projected at the time of his arrest and in continuance of ongoing IC operations.

On 28 Mar 24, Sam Bankman-Fried will be sentenced in his fraud trial and he faces 100 years in prison.

The evidence for the pretext of Bankman-Fried’s reduced sentence is already on the table.

In reporting from Left-centered Slate on 06 Mar 24,

But something surprising has happened since Bankman-Fried’s conviction: The professionals running FTX’s bankruptcy have started to sound optimistic that the exchange’s customers and creditors would get all their money back, ostensibly thanks to a mixture of continually rebounding crypto prices, the bankruptcy team’s work to get a handle on FTX’s finances, and some of FTX’s equity investments performing well. It’s “not a guarantee, but an objective,” one of the company’s lawyers told a Delaware court in late January.

Unsurprisingly, Bankman-Fried’s lawyers argue that this development should be a factor in meaningfully lowering his sentence. “The harm to customers, lenders, and investors is zero,” they wrote in a filing to the judge on Feb. 27. The lawyers further argue that Bankman-Fried was just one player in a crime that did not wind up costing his customers and creditors. They say Bankman-Fried is “a non-violent offender, who was joined in the conduct at issue by at least four other culpable individuals, in a matter where victims are poised to recover—were always poised to recover—a hundred cents on the dollar.” Bankman-Fried, who just turned 32, has officially requested a sentence of between 63 and 78 months, which would net out to no more than six and a half years. If he served 85 percent of that sentence and received parole, he’d be out in five and a half—perhaps fewer, if the court gave him credit for time spent in jail over the past year.

On the surface, it sounds somewhat reasonable: If Bankman-Fried’s crimes won’t wind up costing other people anything close to what everyone thought, shouldn’t he get a lighter sentence? Maybe! But there are a lot of “buts” to consider, “buts” that could get in the way of Bankman-Fried’s hopes.

[…]

Of all the arguments Bankman-Fried’s lawyers make in their 90-page sentencing submission to the judge, the one about the (likely) lack of customer and creditor loss is the strongest. The lawyers argue that FTX did not face a solvency crisis but a liquidity crisis, echoing a point Bankman-Fried made as soon as FTX started to circle the drain in the fall of 2022. Back then, that was a distinction without a difference.

[…]

Bankman-Fried’s team makes other points that may or may not land. The lawyers say he is “already being punished,” citing bad conditions in the jails he’s lived in over the past 18 months and lots of (often antisemitic) harassment.

[…]

His team also argues that Bankman-Fried’s autism spectrum disorder “would render him extraordinarily vulnerable to abuse in prison” from both other inmates and guards. Bankman-Fried’s mother, in her own letter, says that “he is bad at responding to social cues in ‘normal’ ways” and would not find rehabilitation in a long sentence. “Being consigned to prison for decades will destroy Sam as surely as would hanging him, because it will take away everything in the world that gives his life meaning,” she writes.

[…]

“Defendants very frequently call into question the damage that was actually done to victims,” Maimin said. But that doesn’t always pan out, because “the sentencing guidelines are not just based upon loss. They’re based upon intended loss. If the jury found that he purposefully committed fraud in a certain amount, even if he didn’t succeed, his guidelines range would still be the same. In the eyes of the judge, that might be a mitigating factor, but it also might not, because that has nothing to do with the defendant’s conduct. It has to do with a factor beyond the defendant’s control: the crypto market.”

Slate

Did you catch it?

Sam Bankman-Fried’s crimes that cost his clients an estimated $8 billion is now an “echoing point.”

As an overlay to the existing analysis and in summary, Slate is establishing the pretext narrative for Sam Bankman-Fried’s reduced sentencing that was projected upon SBF’s arrested and for the reasons that:

A lesser degree of loss and victimization, which is a rhetorical and baseless predicate to mitigate the fact set to reduce SBF’s sentencing – “the exchange’s customers and creditors would get all their money back.”

Slate’s enthusiastic rhetoric that is for low-information consumers and serves as a measure to influence public opinion justifying a reduced sentence for SBF – “On the surface, it sounds somewhat reasonable: If Bankman-Fried’s crimes won’t wind up costing other people anything close to what everyone thought, shouldn’t he get a lighter sentence? Maybe!”

SBF’s sentence should be reduced because he’s already serving time pending trial, which is the same for hundreds of thousands of other Americans as – “The lawyers say he is “already being punished.”

SBF is a classic victim here because of his autism and other cognitive, social and emotional issues – “His team also argues that Bankman-Fried’s autism spectrum disorder “would render him extraordinarily vulnerable to abuse in prison”.”

The rationale behind SBF’s counsel’s argument for reduced sentencing relative to the performance of the crypto market bears an incredibly important question: To what degree if any has the Biden Administration deliberately and directly or indirectly interfered in the crypto market to influence its performance to align and comport with the narrative for the SBF trial and and SBF’s projected reduced sentencing – “thanks to a mixture of continually rebounding crypto prices”?

Before making-up your mind on SBF and the projected reduced sentence, remember who the judge is as I reported back on 28 Dec 22: The Keystone of Corruption: The projected FTX fix is unpacking in the full public spectrum.

The projection and analysis remain on straight rails and in 15 days, we’ll know for sure.

Expect Sam Bankman-Fried to receive a reduced sentence and expect it to be for a bunch of flimsy reasons far outside any reasonable or cogent dialogue underpinned by the matriculation of justice as framed by the US Constitution.

Joe Biden was the primary beneficiary of the FTX money laundering and political kickback operation and that is why the FTX fix is in and has been since before SBF’s arrest.

-End-

If you appreciate the analysis at Moonshine, please consider actively sharing it on social media where accounts remain ghost- and shadow-banned and sharing the work is difficult. Thank you.

I lost a bunch in ftx. I may be whole as of petition date in USD.

BUT - my holdings are worth 25% more now. So, yeah - people were harmed. We owned golden crypto and are getting back fiat trash.

For sure...Ukraine can launder anything...but let's not forget Pelosi MCConnell, and a LOT of others in DC...plus their nephews and sons in laws...plus plus plus....and then they had the BALLS to try and blame CRYPTO. itself....and I am not sure what is worse....trying to take crypto down, or LARRY FINK (god what an appropriate name) now trying to corner the market on bitcoin......

It never ends...the corruption of the human soul.