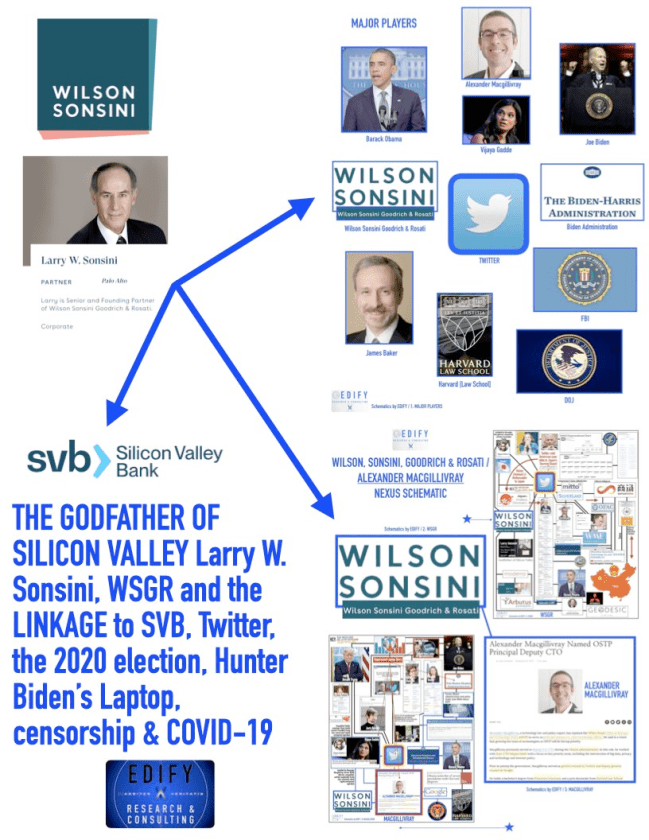

Silicon Valley Bank, Wilson Sonsini Goodrich & Rosati and Larry W. Sonsini

The linkage between Silicon Valley Bank, Wilson Sonsini Goodrich & Rosati and Larry W. Sonsini as resting on existing analysis from EDIFY Research & Consulting.

Silicon Valley Bank has become insolvent. How much do you know about Silicon Valley Bank, Larry W. Sonsini, Wilson Sonsini Goodrich & Rosati, Twitter, China, the 2020 election, Hunter Biden’s laptop, COVID-19, censorship, the FBI, Obama & Biden? They’re all intricately linked in problematic ways. It all falls back on old analysis from September 2022.

Here’s how beginning with partner and founder of Wilson Sonsini Goodrich & Rosati and the Godfather of Silicon Valley, Larry W. Sonsini.

THIS ARTICLE IS TO RECONCILE LOW RESOLUTION IMAGES IN THE ORIGINAL TWITTER THREAD:

Here is how Sonsini fits into the existing analysis, which is to be found in three parts:

EDIFY: Critical Nexus: Twitter, WSGR, Macgillivray & White House

EDIFY: Critical Nexus II: Vadde, Twitter, WSGR, Biden & Durban

EDIFY: Brief III: The Twitter/WSGR/White House Censorship Network

Extractions from this item as pictured here are quoted below: Larry W. Sonsini.

From the linked item:

The Senior and Founding Partner of Wilson Sonsini Goodrich & Rosati, Larry W. Sonsini has gained international recognition for his expertise in the areas of corporate law, corporate governance, securities, and mergers and acquisitions. He has been instrumental in many of the financings, IPOs, mergers, acquisitions, and other key transactions of Silicon Valley and beyond.

In addition to his duties at the firm, which included serving as chief executive officer as well as chairman for more than 35 years, Larry was chairman of the New York Stock Exchange’s Commission on Corporate Governance, which was formed in 2009 and issued its final report in fall 2010. He is also a member of the NYSE’s Proxy Working Group and served as a member of the NYSE’s board of directors from 2001 to 2003. In addition, he served as chairman of the NYSE’s Regulation, Enforcement and Listing Standards Committee until 2008, and previously was a member of the NYSE’s Legal Advisory Committee and the NYSE Committee for Review.

Larry has served on a number of advisory boards and committees, including: the SEC’s Advisory Committee on Capital Formation and Regulatory Processes; ABA Committee on Federal Regulation of Securities; and Legal Advisory Board of NASD, Inc. Additionally, he is a member of the board of trustees and a founding fellow of the American College of Governance Counsel.

In 1999, Larry was selected as a member of the American Academy of Arts and Sciences. He is a trustee of Santa Clara University (SCU), was recently chosen as the honorary chair of SCU’s High Technology Law Institute, and is a Foreign Policy Association Fellow. Larry was formerly a trustee at the University of California, Berkeley (1990-1996), and has served on the Board of Advisors of the Technical Law Journal at Boalt Hall. He has taught at Stanford Law School and UC Berkeley School of Law.

WSGR

From the WSGR website:

Wilson Sonsini Goodrich & Rosati’s legacy closely traces the birth and evolution of Silicon Valley.

For more than six decades, Wilson Sonsini has represented the technology pioneers associated with virtually every milestone innovation.

Today, the firm is synonymous with ushering promising, innovative companies through their business life cycle.

WSGR

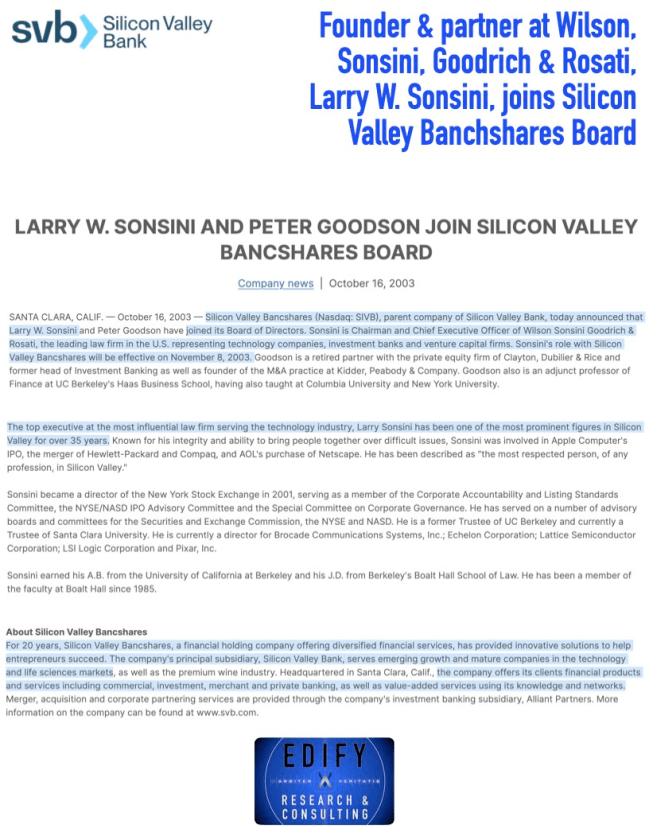

In October 2003 it was reported that Sonsini joined Silicon Valley Bancshares Board: LARRY W. SONSINI AND PETER GOODSON JOIN SILICON VALLEY BANCSHARES BOARD.

SANTA CLARA, CALIF. — October 16, 2003 — Silicon Valley Bancshares (Nasdaq: SIVB), parent company of Silicon Valley Bank, today announced that Larry W. Sonsini and Peter Goodson have joined its Board of Directors. Sonsini is Chairman and Chief Executive Officer of Wilson Sonsini Goodrich & Rosati, the leading law firm in the U.S. representing technology companies, investment banks and venture capital firms. Sonsini’s role with Silicon Valley Bancshares will be effective on November 8, 2003. Goodson is a retired partner with the private equity firm of Clayton, Dubilier & Rice and former head of Investment Banking as well as founder of the M&A practice at Kidder, Peabody & Company. Goodson also is an adjunct professor of Finance at UC Berkeley’s Haas Business School, having also taught at Columbia University and New York University.

“Larry and Peter represent a truly impressive accumulation of knowledge, experience and achievement, and will be a tremendous asset to the board,” said Ken Wilcox, president and CEO of Silicon Valley Bancshares and Silicon Valley Bank. “The insight they will bring to our corporate governance — through their experience as entrepreneurs, executives and respected corporate directors — will allow Silicon Valley Bancshares to chart a course for success in the next 20 years.”

The top executive at the most influential law firm serving the technology industry, Larry Sonsini has been one of the most prominent figures in Silicon Valley for over 35 years. Known for his integrity and ability to bring people together over difficult issues, Sonsini was involved in Apple Computer’s IPO, the merger of Hewlett-Packard and Compaq, and AOL’s purchase of Netscape. He has been described as “the most respected person, of any profession, in Silicon Valley.”

Sonsini became a director of the New York Stock Exchange in 2001, serving as a member of the Corporate Accountability and Listing Standards Committee, the NYSE/NASD IPO Advisory Committee and the Special Committee on Corporate Governance. He has served on a number of advisory boards and committees for the Securities and Exchange Commission, the NYSE and NASD. He is a former Trustee of UC Berkeley and currently a Trustee of Santa Clara University. He is currently a director for Brocade Communications Systems, Inc.; Echelon Corporation; Lattice Semiconductor Corporation; LSI Logic Corporation and Pixar, Inc.

Sonsini earned his A.B. from the University of California at Berkeley and his J.D. from Berkeley’s Boalt Hall School of Law. He has been a member of the faculty at Boalt Hall since 1985.

[…]

About Silicon Valley Bancshares

For 20 years, Silicon Valley Bancshares, a financial holding company offering diversified financial services, has provided innovative solutions to help entrepreneurs succeed. The company’s principal subsidiary, Silicon Valley Bank, serves emerging growth and mature companies in the technology and life sciences markets, as well as the premium wine industry. Headquartered in Santa Clara, Calif., the company offers its clients financial products and services including commercial, investment, merchant and private banking, as well as value-added services using its knowledge and networks. Merger, acquisition and corporate partnering services are provided through the company’s investment banking subsidiary, Alliant Partners. More information on the company can be found athttp://www.svb.com

.

Silicon Valley Bank

Here’s an example of the partnership between SVB and WSGR noting biotech overlays: Silicon Valley Bank Leads Group of Sponsors Funding LabCentral Ignite Programs to Support Underrepresented Life Sciences Entrepreneurs.

Wilson Sonsini Goodrich & Rosati, EisnerAmper, and Alira Health part of group sponsoring LabCentral Ignite’s 2023 Golden Ticket competition and fellowship program supporting diverse founders in the life sciences

CAMBRIDGE, Mass., Feb. 23, 2023 /PRNewswire/ — Silicon Valley Bank has assembled a diverse group of organizations, including Wilson Sonsini Goodrich & Rosati, EisnerAmper, and Alira Health, to sponsor LabCentral Ignite, a first-and-only-of-its-kind platform to address systemic racial, gender, and other underrepresentation in talent across the life sciences and biotech industry.

In addition to their banking, legal, accounting, and healthcare consulting expertise for the life sciences industry, the financial contribution from these sponsors will support Ignite’s entrepreneur programming, such as the LabCentral Ignite Golden Ticket competition and the accompanying Ignite Fellowship.

The LabCentral Ignite Golden Ticket contest was designed to support biotech entrepreneurs who identify as women, Black, Latinx, Indigenous, or other persons of color who are using innovative science to solve human health problems. Winners receive free access to LabCentral’s shared lab space in Cambridge. In addition, winners participate in a year-long Ignite Fellowship program that aims to supercharge their networks, connecting these entrepreneurs to top investors, partners, advisors, and mentors.

“As Ignite enters our third year, we remain dedicated to amplifying the voices and expanding opportunities for those who have historically been excluded from this industry so they can focus on changing the world through groundbreaking science. Thanks to the support of Silicon Valley Bank, Wilson Sonsini Goodrich & Rosati, EisnerAmper, and Alira Health, who believe in our mission, we can support more underrepresented entrepreneurs with the potential to significantly impact biotech and the life sciences,” said Gretchen Cook-Anderson, LabCentral Ignite’s Executive Director.

“At Silicon Valley Bank, we know that diverse perspectives and inclusive environments ignite new ideas and power innovation,” said Anton Xavier, Director, SVB Startup Banking. “The LabCentral Ignite program spotlights often overlooked communities in biotech and life sciences and creates opportunities to foster a culture of inclusion in the industry.”

CISION PR Newswire

Here’s an example of the partnership between SVB & WSGR noting how SVB functions in the capacity of private banking and fundraising: Private Capital Data Analytics Platform Aumni Raises $10 Million Series A.

Salt Lake City, Utah (January 28, 2020) – Aumni, Inc., a SaaS company developing a robotic process automation and data analytics platform for private capital investors, announced a $10 million Series A funding round led by SVB Financial Group, the parent company of Silicon Valley Bank. The round also included participation from existing investors Moneta Ventures, Next Frontier Capital and Quiet Ventures, who together previously led Aumni’s $3.7 million Series Seed round. New investors also include Kickstart Seed Fund, Blackhorn Ventures, Prelude and Service Provider Capital. This announcement follows a pivotal year of growth and achievement for Aumni with its core product offering poised for scale and expansion in 2020.

“SVB is the ideal lead Series A investor for our company. With SVB’s support, we’re even better positioned to expand our offering and achieve our goal of changing the landscape of the private capital markets ecosystem,” said Anthony Lewis, Co-Founder & CEO of Aumni. “We’re also grateful for the insight and input from our early customers, advocates and investors who helped us get here, and the team is now positioned to achieve great things in 2020 and beyond.”

“Aumni’s platform empowers investors at venture firms, corporate venture funds and family offices with the ability to unlock and structure the untapped data living inside their portfolios,” said Mike Descheneaux, president of Silicon Valley Bank. “We know that our investor client base is eager to leverage data to enhance decision making and track performance, so we’re proud to support Aumni’s growth and expansion plans in their quest to drive value for the private capital markets.”

About Aumni

Aumni was founded by Anthony Lewis and Kelsey Chase, two attorneys from top corporate law firms Latham & Watkins, Wilson Sonsini and DLA Piper. Aumni is solving a common pain point for investors in private capital markets by developing a turn-key SaaS platform that extracts, audits, and tracks thousands of investment data points directly from definitive investment agreements. Today, Aumni works with prestigious traditional venture funds, corporate venture funds and family offices and is quickly becoming the standard for automating legal operations and investment data analytics for private capital markets. Learn more or connect with Aumni at www.aumni.fund.

Aumni

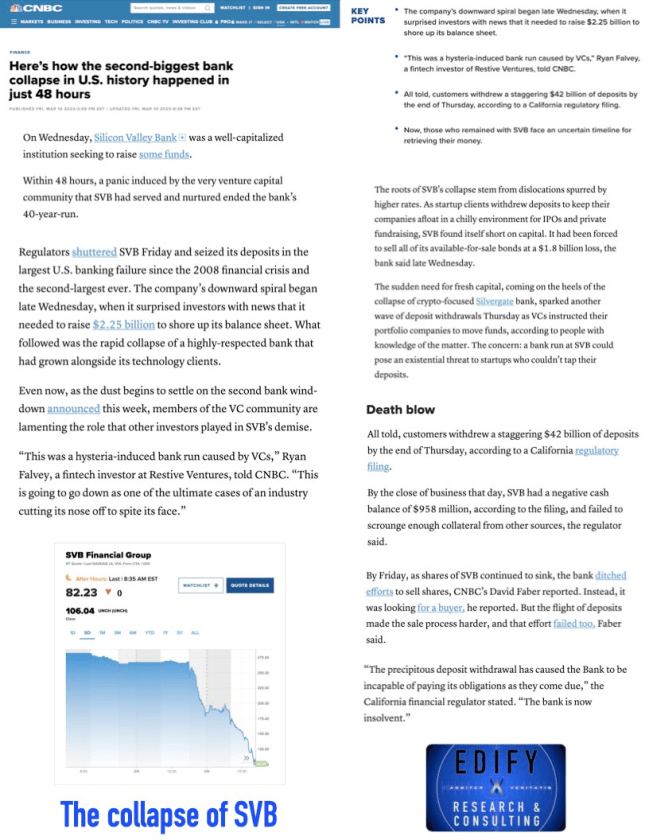

The collapse of SVB: Here’s how the second-biggest bank collapse in U.S. history happened in just 48 hours.

The company’s downward spiral began late Wednesday, when it surprised investors with news that it needed to raise $2.25 billion to shore up its balance sheet.

“This was a hysteria-induced bank run caused by VCs,” Ryan Falvey, a fintech investor of Restive Ventures, told CNBC.

All told, customers withdrew a staggering $42 billion of deposits by the end of Thursday, according to a California regulatory filing.

Now, those who remained with SVB face an uncertain timeline for retrieving their money.

On Wednesday, Silicon Valley Bank was a well-capitalized institution seeking to raise some funds.

Within 48 hours, a panic induced by the very venture capital community that SVB had served and nurtured ended the bank’s 40-year-run.

Regulators shuttered SVB Friday and seized its deposits in the largest U.S. banking failure since the 2008 financial crisis and the second-largest ever. The company’s downward spiral began late Wednesday, when it surprised investors with news that it needed to raise $2.25 billion to shore up its balance sheet. What followed was the rapid collapse of a highly-respected bank that had grown alongside its technology clients.

Even now, as the dust begins to settle on the second bank wind-down announced this week, members of the VC community are lamenting the role that other investors played in SVB’s demise.

“This was a hysteria-induced bank run caused by VCs,” Ryan Falvey, a fintech investor at Restive Ventures, told CNBC. “This is going to go down as one of the ultimate cases of an industry cutting its nose off to spite its face.”

[…]

The roots of SVB’s collapse stem from dislocations spurred by higher rates. As startup clients withdrew deposits to keep their companies afloat in a chilly environment for IPOs and private fundraising, SVB found itself short on capital. It had been forced to sell all of its available-for-sale bonds at a $1.8 billion loss, the bank said late Wednesday.

The sudden need for fresh capital, coming on the heels of the collapse of crypto-focused Silvergate bank, sparked another wave of deposit withdrawals Thursday as VCs instructed their portfolio companies to move funds, according to people with knowledge of the matter. The concern: a bank run at SVB could pose an existential threat to startups who couldn’t tap their deposits.

Death blow

All told, customers withdrew a staggering $42 billion of deposits by the end of Thursday, according to a California regulatory filing.

By the close of business that day, SVB had a negative cash balance of $958 million, according to the filing, and failed to scrounge enough collateral from other sources, the regulator said.

By Friday, as shares of SVB continued to sink, the bank ditched efforts to sell shares, CNBC’s David Faber reported. Instead, it was looking for a buyer, he reported. But the flight of deposits made the sale process harder, and that effort failed too, Faber said.

[…]

“The precipitous deposit withdrawal has caused the Bank to be incapable of paying its obligations as they come due,” the California financial regulator stated. “The bank is now insolvent.”

CNBC

Continuing with the collapse of SVD: Silicon Valley Bank’s demise began with downgrade threat.

March 11 (Reuters) – In the middle of last week, Moody’s Investors Service Inc delivered alarming news to SVB Financial Group (SIVB.O), the parent of Silicon Valley Bank: the ratings firm was preparing to downgrade the bank’s credit.

That phone call, described by two people familiar with the situation, began the process toward Friday’s spectacular collapse of the startup-focused lender, the biggest bank failure since the 2008 financial crisis.

[…]

Details of SVB’s failed response to the prospect of the downgrade, reported by Reuters for the first time, show how quickly confidence in financial institutions can erode. The failure also sent shockwaves through California’s startup economy, with many companies unsure how much of their deposits they can recover and worrying about how to make payroll.

THE UNRAVELING

As SVB executives debated when to proceed with the fundraising, they heard from Moody’s that the downgrade was coming this week, the sources said.

SVB sprang into action in the hopes of softening the blow.

The bank lined up private equity firm General Atlantic, which agreed to buy $500 million of the $2.25 billion stock sale, while another investor said it could not reach a deal on SVB’s timeline, the sources said.

By Wednesday, SVB had sold the bond portfolio for a $1.8 billion loss.

Moody’s downgraded the bank, but only by a notch because of SVB’s bond portfolio sale and plan to raise capital.

Reuters

WSGR has direct linkage to COVID-19 via the lipid nanoparticle envelop as the required “vaccine” delivery platform. This is old analysis: It’s All About the Lipid Nanoparticle Envelope: Wilson Sonsini and the Moderna Case Against Pfizer and BioNTech.

Wilson Sonsini Goodrich & Rosati

Of concern is the nature of Wilson Sonsini as a firm that rivals Kirkland & Ellis, King & Spaulding and Perkins Coie as one of the most monstrous and swampy law firms around. I’ve heard Wilson Sonsini described as a powerhouse of 1000 attorneys representing the biggest and worst corporations on the planet. Moreover, the firm is enmeshed in insider trading crimes. If that isn’t enough, one of its partners is reportedly known as “The Godfather of Silicon Valley”.

I’ve even seen evidence linking the firm to other important matters but those exclusively sourced angles are for a future article; once I’m permitted to write it.

[…]

Moderna, Arbutus & Lipid Nanoparticle Envelopes

Moderna’s suit against Pfizer and BioNTech draws Wilson Sonsini into the picture via a Canadian pharmaceutical company called Arbutus. Arbutus is critical to the COVID-19 construct for reasons covered in detail while examining and reporting on Dr. David E. Martin’s corpus of work into the existing 40,000 U.S. patent filings pertaining to the bioengineered SARS-CoV-2 virus. From the 24 Jul 21 Moonshine article:

Also in March of 2019, a series of rejected patent filings were amended and described as a very bizarre behavior. The amended filings were such that a “deliberate release” of coronavirus be included in the filing.

There were 4 failed patent applications amended to begin the process of a coronavirus vaccine development program and they began dealing with a significant problem of relying upon technology they did not own.

Two Canadian companies – Arbutus Pharmaceuticals and Acuitas Pharmaceuticals actually own the patent on the lipid nanoparticle envelope that’s required to deliver the injection of the mRNA fragment.

The respective patents have been issued in Canada, in the U.S. and around the world and in their world intellectual property equivalents.

Again, Moonshine’s initial investigative vectors on vaccine patent and patent-sharing agreements bear down with full might here.

Moderna knew it didn’t own the rights and entered negotiations with Arbutus and Acuitas to resolve the patent issues and permit the technology to be put into a vaccine.

Political Moonshine

In this 01 Dec 21 brief from Wilson Sonsini, we ascertain the important details and of particular interest to our focus here is of course the name Arbutus. The brief also provides an excellent and succinct description for the inherent value found in the patents for the lipid nanoparticle envelope. It amounts to proper the motive and the absolute necessity behind attaining the patents:

On December 1, 2021, the Federal Circuit affirmed the Patent Trial and Appeal Board’s (PTAB’s) earlier rulings that ModernaTX, Inc. (formerly Moderna Therapeutics Inc.) failed to invalidate claims in two Arbutus Biopharma Corp. patents, known as the ‘069 and ’435 patents, and left the ‘069 patent fully intact. The trading price of Arbutus shares jumped as much as 95 percent after the court posted its opinions on its electronic docket. Wilson Sonsini Goodrich & Rosati represented Arbutus in the matter.

Arbutus’s U.S. Patent Nos. 8,058,069 and 9,364,435 relate to a composition based on lipid nanoparticle (LNP) technology that delivers nucleic acid payloads to allow the human body to make its own therapeutic proteins.

According to a recent Reuters article, “Moderna previously said in court filings that it believes Arbutus could bring a lawsuit demanding royalties from its COVID-19 vaccine if the patents were upheld.” Reuters reported that Moderna “last month forecast 2021 sales of between $15 billion and $18 billion, and 2022 sales of between $17 billion and $22 billion, for its COVID-19 vaccine.”

The Wilson Sonsini team that represented Arbutus Biopharma in the matter includes Michael Rosato, Sonja Gerrard, Steve Parmelee, Lora Green, and Jad Mills.

For more information, please see these Reuters and Bloomberg articles covering the decisions.

WSGR

In short, if the vaccine manufacturers did not secure the rights to the lipid nanoparticle envelope, there would be no mRNA “vaccines” at all ergo there could be no “pandemic” at all. The kids [payload] don’t get to school if there’s no school bus [lipid nanoparticle envelope] to deliver them.

When I was asked to generalize the case, I stated this quoting a source in private dialogue:

It’s over royalties pertaining to the lipid nanoparticle envelope used to deliver the genetic material in the mRNA injections. Arbutus holds two patents that tie to Moderna’s mRNA injection ergo they seek royalties accordingly. “Moderna previously said in court filings that it believes Arbutus could bring a lawsuit demanding royalties from its COVID-19 vaccine if the patents were upheld.” Reuters reported that Moderna “last month forecast 2021 sales of between $15 billion and $18 billion, and 2022 sales of between $17 billion and $22 billion, for its COVID-19 vaccine.”

Political Moonshine

Political Moonshine

To continue on for the backstory and granular details of Larry W. Sonsini and WSGR from September 2022 analysis, read the three articles linked above from EDIFY Research & Consulting.

-End-

As usual, great connect the dots. Larry had his fingers in many dirty pies.

So thorough! So good!